Global economic crisis

Moderator: S2k Moderators

-

Ed Mahmoud

Re: Global economic crisis: Dow falls more than 700 points again

For that money, I strongly suspect Social Security has always been a Ponzi scheme, a pyramid sham, depending on a growing population. From what I understand, based on actuarial norms of life span, income, inflation, etc., people who retired before the mid 90s "won", got more money out of SS than they paid in, NPV wise, and those of us still working are losers. Why neither major political party seems serious on illegal immigration. It balances declining birth rates. They can keep raising the payroll tax, pushing the retirement age back, impose caps on the automatic cost of living increases, but at some point the tail end of the baby boomers will still be living and drawing checks, and the burden on the two or three wage earners carrying them will become too much and it'll collapse. Maybe with a whimper, with retirement age pushed to near the average age of death, followed by some kind of plan to ease people who are just entering the work force out of it entirely.

Just got me thinking, since much of the supposed 'surplus' in Social Security now buys government debt that will supposedly pay it back in the future.

Just got me thinking, since much of the supposed 'surplus' in Social Security now buys government debt that will supposedly pay it back in the future.

0 likes

- gtalum

- S2K Supporter

- Posts: 4749

- Age: 50

- Joined: Tue Sep 07, 2004 3:48 pm

- Location: Bradenton, FL

- Contact:

Social Security is, by definition, a Ponzi scheme. It's the only legal one that I know of.

It looks great on paper until you realize there is a finite maximum population that the US can support. That's why "contributions" (I love when they use that word ) have gone from 1% of the first $3000 of income in 1933 to the current 15% of the first $102,000 of income today. To support current benefits, the "contributions" will have to be jacked up severely.

) have gone from 1% of the first $3000 of income in 1933 to the current 15% of the first $102,000 of income today. To support current benefits, the "contributions" will have to be jacked up severely.

It looks great on paper until you realize there is a finite maximum population that the US can support. That's why "contributions" (I love when they use that word

0 likes

Re: Global economic crisis: Dow falls more than 700 points again

Will the double bottom hold, that will be the question.

0 likes

- Dionne

- S2K Supporter

- Posts: 1616

- Age: 74

- Joined: Mon Jan 02, 2006 8:51 am

- Location: SW Mississippi....Alaska transplant via a Southern Belle.

Re: Global economic crisis: Dow falls more than 700 points again

Nimbus wrote:Will the double bottom hold, that will be the question.

Kind of looks like we're going to see more of the "bottom" today.....would the last person leaving please turn off the lights?

0 likes

-

Derek Ortt

-

Brent

- S2K Supporter

- Posts: 38683

- Age: 37

- Joined: Sun May 16, 2004 10:30 pm

- Location: Tulsa Oklahoma

- Contact:

Re: Global economic crisis: Dow below 7,600

Here we go again...

DOW

7553.48

-443.80

-5.55%

NASDAQ

1316.71

-69.71

-5.03%

S&P 500

752.62

-53.96

-6.69%

Lost almost half it's value in about 13 months.

DOW

7553.48

-443.80

-5.55%

NASDAQ

1316.71

-69.71

-5.03%

S&P 500

752.62

-53.96

-6.69%

Lost almost half it's value in about 13 months.

0 likes

- cycloneye

- Admin

- Posts: 148895

- Age: 69

- Joined: Thu Oct 10, 2002 10:54 am

- Location: San Juan, Puerto Rico

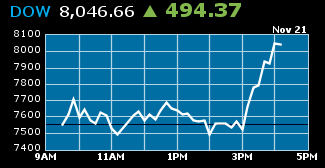

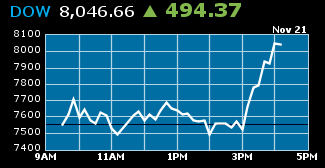

Re: Global economic crisis: Dow above 8,000

The dow climbed 494 points on Friday as the news broke at 3 PM EST that the President elect nominates a new Treasury Secretary (Tim Geithner).This removes the uncertainty that the markets had about when the new economic team would be nominated.

DOW 8046.42 494.13= +6.54%

NASDAQ 1384.3568.23= +5.18%

S&P 500 800.0347.59= +6.32%

http://www.cnbc.com/id/27843564

http://www.cnbc.com/id/27844707

DOW 8046.42 494.13= +6.54%

NASDAQ 1384.3568.23= +5.18%

S&P 500 800.0347.59= +6.32%

http://www.cnbc.com/id/27843564

http://www.cnbc.com/id/27844707

0 likes

- cycloneye

- Admin

- Posts: 148895

- Age: 69

- Joined: Thu Oct 10, 2002 10:54 am

- Location: San Juan, Puerto Rico

Global economic crisis: Dow closed up 396 at 8443 on Monday

DJIA=8443.39-396.97 +4.93% 2,156,489,000.

NCOMP=1472.02-87.67 +6.33% 1,128,759,400.

SPX=851.81-51.78 +6.47%6 318,001,900

http://www.cnbc.com/id/27894286

Another rally to the upside for a second day in a row.

NCOMP=1472.02-87.67 +6.33% 1,128,759,400.

SPX=851.81-51.78 +6.47%6 318,001,900

http://www.cnbc.com/id/27894286

Another rally to the upside for a second day in a row.

0 likes

Re: Global economic crisis:

All the discount e brokers use a "street name" pool to buffer the online buying and selling.

Obviously the pool is not large enough to cover the day trader limit swings so the big pools are moving the market.

Its like watching the wave go around a sports arena.

As more and more e traders are getting wise to playing the wave the swings have become sharper and easier to call.

I suppose this phenomena helps bring outside money into the stock market.

A breakout to the downside is less likely if people are waiting for any sign of rebound near 7500.

Obviously the pool is not large enough to cover the day trader limit swings so the big pools are moving the market.

Its like watching the wave go around a sports arena.

As more and more e traders are getting wise to playing the wave the swings have become sharper and easier to call.

I suppose this phenomena helps bring outside money into the stock market.

A breakout to the downside is less likely if people are waiting for any sign of rebound near 7500.

0 likes

- cycloneye

- Admin

- Posts: 148895

- Age: 69

- Joined: Thu Oct 10, 2002 10:54 am

- Location: San Juan, Puerto Rico

Re: Global economic crisis: Dow up 36 points at 8479 on Tuesday

Not a huge rally but anyway,the dow finished up 36 points.Its the third day of trading in a row that the dow closes up.

DJIA=8479.47 +36.08+0.43% - 1,558,623,000.

NCOMP=1464.73 -7.29 -0.5% - 1,070,742,700.

SPX=857.41 +5.60 +0.66% - 5,342,421,100.

http://www.cnbc.com/id/27912769

DJIA=8479.47 +36.08+0.43% - 1,558,623,000.

NCOMP=1464.73 -7.29 -0.5% - 1,070,742,700.

SPX=857.41 +5.60 +0.66% - 5,342,421,100.

http://www.cnbc.com/id/27912769

0 likes

- Stephanie

- S2K Supporter

- Posts: 23843

- Age: 63

- Joined: Thu Feb 06, 2003 9:53 am

- Location: Glassboro, NJ

Re: Global economic crisis

I'll take that kind of close any day. I'm sure that there will be more dips, but hopefully this pendulum swing is starting to become less extreme.

0 likes

- cycloneye

- Admin

- Posts: 148895

- Age: 69

- Joined: Thu Oct 10, 2002 10:54 am

- Location: San Juan, Puerto Rico

Re: Global economic crisis

For a fourth trading day in a row,the dow rallies higher,today +247 points closing at 8726.

DJIA=8726.61+247.14 +2.91% 1,296,491,000.

NCOMP=1532.10 +67.37 +4.6%796,518,600.

SPX=887.68+30.29 +3.53% 4,339,280,300

http://www.cnbc.com/id/27930306

DJIA=8726.61+247.14 +2.91% 1,296,491,000.

NCOMP=1532.10 +67.37 +4.6%796,518,600.

SPX=887.68+30.29 +3.53% 4,339,280,300

http://www.cnbc.com/id/27930306

0 likes

- cycloneye

- Admin

- Posts: 148895

- Age: 69

- Joined: Thu Oct 10, 2002 10:54 am

- Location: San Juan, Puerto Rico

Re: Global economic crisis

Fridays trading session closed at 1 PM EST and it resulted in the fith strait trading day of gains in the dow,that was +102.

http://www.cnbc.com/id/27956130

http://www.cnbc.com/id/27956130

0 likes

- cycloneye

- Admin

- Posts: 148895

- Age: 69

- Joined: Thu Oct 10, 2002 10:54 am

- Location: San Juan, Puerto Rico

Re: Global economic crisis

It looks like the 5 consecutive trading days having the dow closing up will be over today as heavy selling is occuring.

Its nothing new or surprise but its now official that the U.S. is in a recession.

The National Bureau of Economic Research, the private, nonprofit, nonpartisan research organization that dates business cycles, said today that the U.S. recession began in December 2007, the date widely believed to be the start date.

The NBER indicates on its Web site that of the 10 recessions since 1945 their average duration was 10 months, with the longest lasting 16 months from July 1981 to November 1982. The recession of 1980 lasted 6 months beginning in January of that year, a fact that makes the period 1980-1982 notable. The longest recession of the 20th century was lasted 43 months, from August 1929 to March 1933. The Depression marked the second longest recession in U.S. history, with the longest lasting 65 months from October 1873 to March 1879.

Risk assets such as equities and corporate bonds have tended historically to begin recovering in the middle of recessions, which to some would make the current period seem a safe time to begin buying, but the depth and the duration of the current recession remains overly unclear.

http://www.cnbc.com/id/27999999

Its nothing new or surprise but its now official that the U.S. is in a recession.

The National Bureau of Economic Research, the private, nonprofit, nonpartisan research organization that dates business cycles, said today that the U.S. recession began in December 2007, the date widely believed to be the start date.

The NBER indicates on its Web site that of the 10 recessions since 1945 their average duration was 10 months, with the longest lasting 16 months from July 1981 to November 1982. The recession of 1980 lasted 6 months beginning in January of that year, a fact that makes the period 1980-1982 notable. The longest recession of the 20th century was lasted 43 months, from August 1929 to March 1933. The Depression marked the second longest recession in U.S. history, with the longest lasting 65 months from October 1873 to March 1879.

Risk assets such as equities and corporate bonds have tended historically to begin recovering in the middle of recessions, which to some would make the current period seem a safe time to begin buying, but the depth and the duration of the current recession remains overly unclear.

http://www.cnbc.com/id/27999999

0 likes

- cycloneye

- Admin

- Posts: 148895

- Age: 69

- Joined: Thu Oct 10, 2002 10:54 am

- Location: San Juan, Puerto Rico

Re: Global economic crisis

The dow ended the mondays session -679 points.

DJIA=8149.09 -679.95 -7.7% 1,242,259,000.

NCOMP=1398.07-137.50 -8.95% 859,289,500.

SPX=816.21-80.03-8.93% 4,511,805,400.

http://www.cnbc.com/id/28001893

DJIA=8149.09 -679.95 -7.7% 1,242,259,000.

NCOMP=1398.07-137.50 -8.95% 859,289,500.

SPX=816.21-80.03-8.93% 4,511,805,400.

http://www.cnbc.com/id/28001893

0 likes

Who is online

Users browsing this forum: No registered users and 47 guests